Apple Stock Financial Analysis

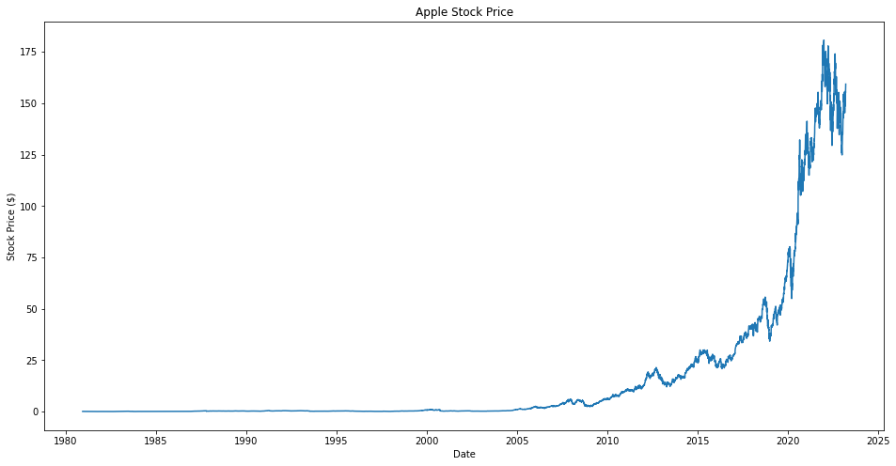

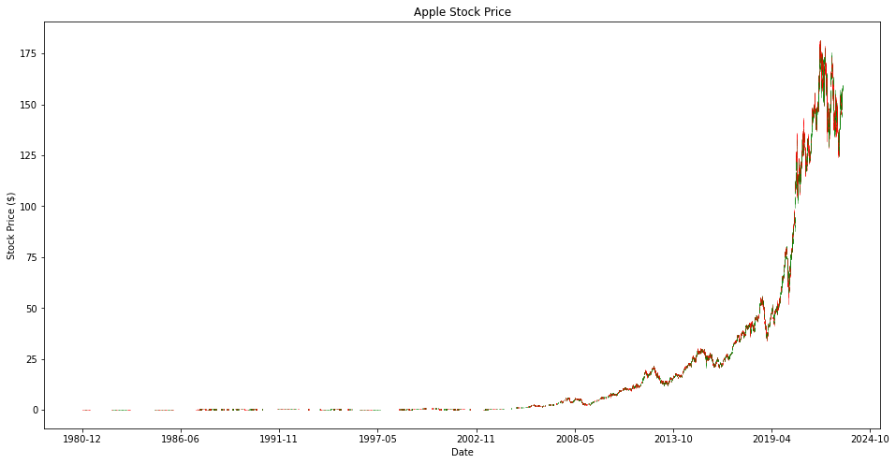

In this Project I analyzed Apple's stock price data using Python and the 'yfinance' package.

The Python code retrieves the data, cleans it,

then visualized the stock price over time using a line plot and candlestick chart

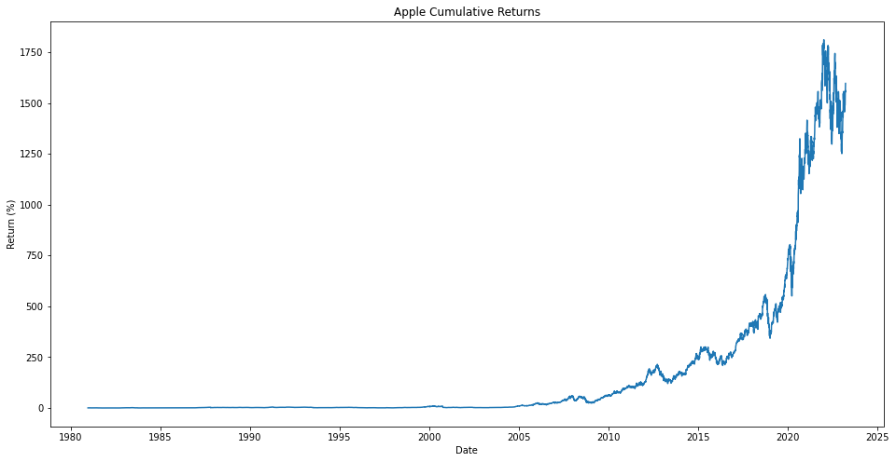

Next, we calculated the daily returns and volatility of the stock,

and plotted its cumulative returns.

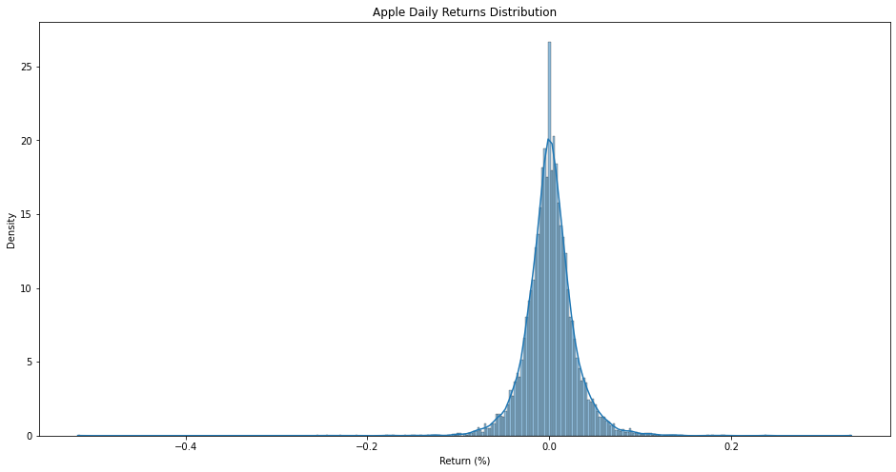

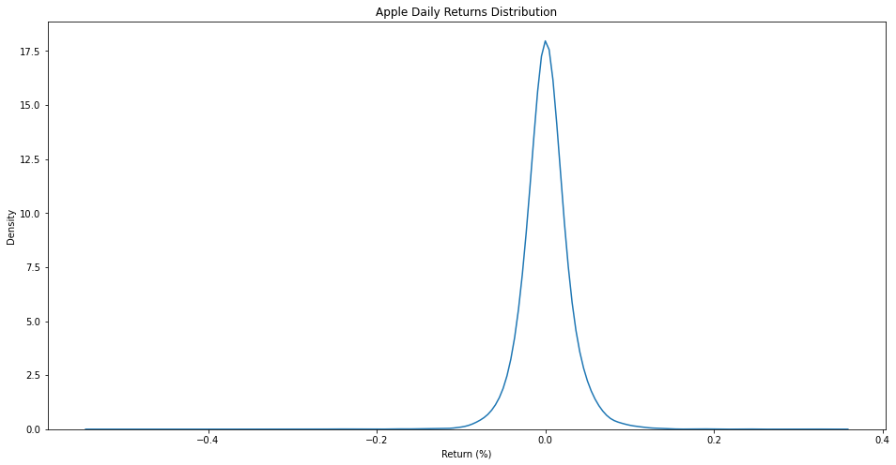

We then used a histogram and density plot to visualize the distribution of daily returns,

and performed a normality test to assess whether the returns follow a normal distribution.

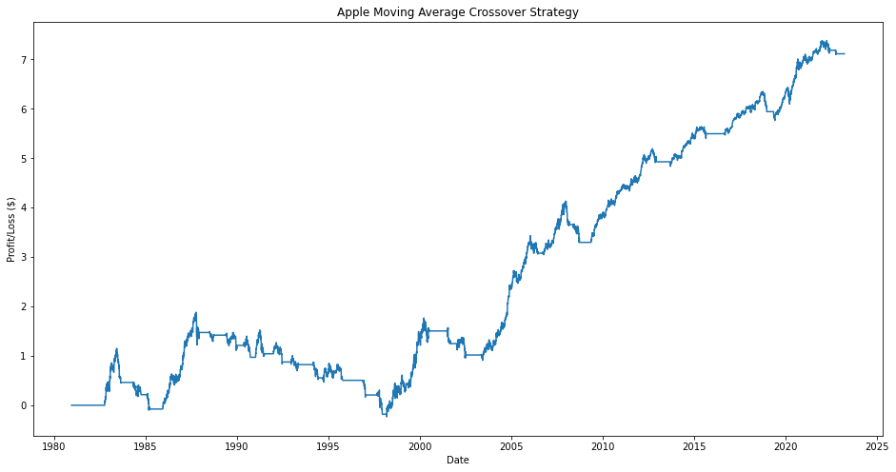

We also implemented a Moving Average Crossover strategy to generate buy/sell signals based on the stock's 50-day and 200-day moving

averages, and calculated the daily profit/loss based on these signals.

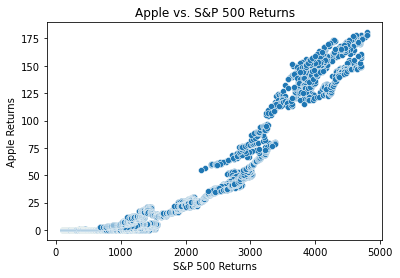

We then examined the correlation between Apple's stock returns and those of the S&P 500

using a scatter plot and correlation coefficient.

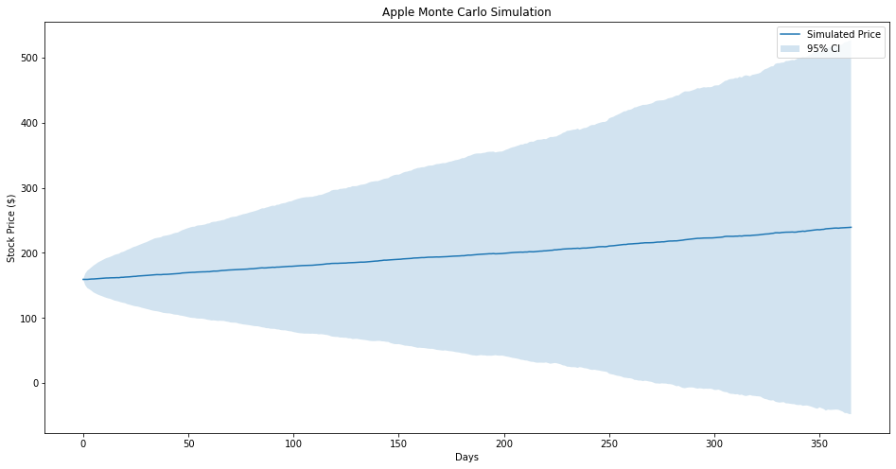

Finally, We performs a Monte Carlo simulation to predict future Apple stock prices based on historical daily returns.

Code

The Python code for this project can be found Here